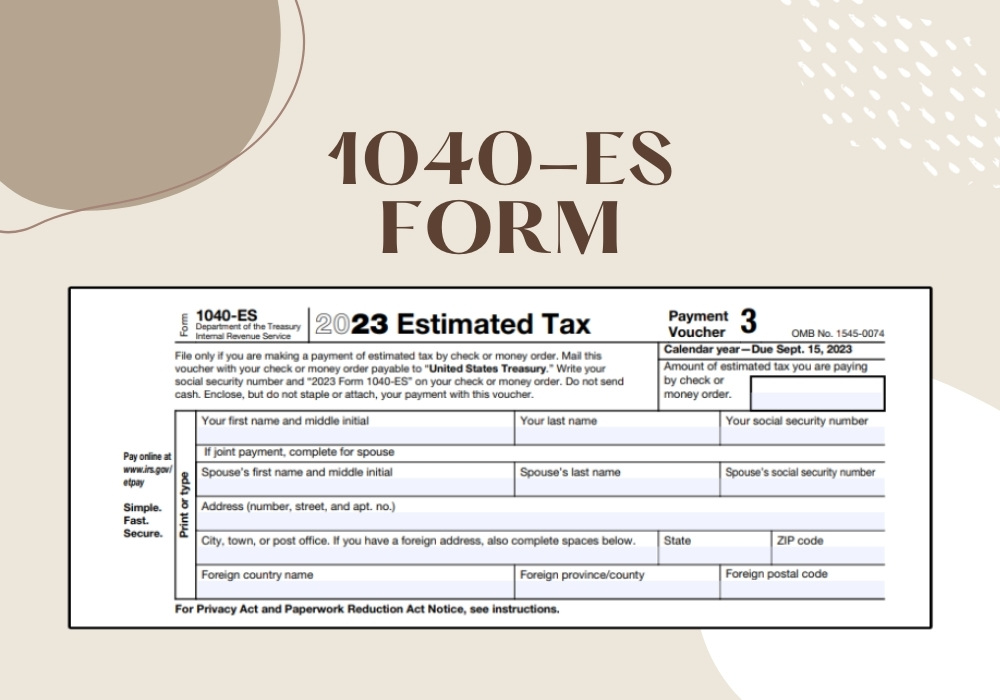

Printable 1040-ES Form for 2023

IRS 1040-ES Tax Form for Print in PDF

Get FormThe IRS Form 1040-ES, known as the Estimated Tax for Individuals, is a crucial document for anyone who needs to pay taxes on income not subject to withholding. This can include earnings from self-employment, interest, dividends, rent, and alimony. This form is designed to assist taxpayers in calculating and paying their estimated taxes quarterly. The layout of the 1040-ES form for print contains several key sections. First, there are worksheets to help you compute your estimated tax. Then, you will find the payment voucher section intended for those who opt to mail their payments rather than pay online. Finally, detailed instructions accompany the form to guide taxpayers on the calculations and the payment process.

Instructions for Completing Printable 1040-ES Form

- Determine Your Expected Adjusted Gross Income

Start by estimating your income for the coming year, taking into account all sources of taxable revenue. - Calculate Deductions and Credits

Next, subtract any expected deductions to arrive at your taxable income, and then apply any credits you anticipate claiming. - Figure Out Your Taxes

Use the 1040-ES tax form printable rates provided in the form's instructions to calculate the amount of taxes that correspond to your taxable income. - Estimate Your Withholding

If you have other income with tax withholding, be sure to estimate this amount so you can subtract it from your total estimated tax. - Complete the Estimated Tax Worksheet

Follow the worksheet in the booklet step by step to find out your estimated fiscal liability. - Fill Out the Vouchers

If you choose to pay via mail, complete the appropriate voucher. Each voucher is clearly labeled for each quarter's payment.

Filing Your Completed IRS Form 1040-ES

After completing the printable 1040-ES form for 2023, you must decide whether to file electronically or via mail. If you opt to file electronically, you can use the IRS Direct Pay system or the Electronic Federal Tax Payment System (EFTPS) for an efficient and secure transfer of funds. For those preferring physical payment methods like checks or money orders, use the vouchers from the 1040-ES estimated tax form printable. Each filled-out voucher should be sent with a corresponding payment. Ensure that your social security number and the tax period are written clearly on the check. It's essential to mail the voucher and payment well before the due date to avoid any penalties for late payments.

Deadlines for Submitting IRS Form 1040-ES in 2024

Staying on top of your payment schedule is crucial when dealing with estimated taxes. For income earned during a given fiscal year, estimated tax payments must be submitted quarterly. The due dates typically fall around April 15th, June 15th, September 15th of the current year, and January 15th of the following year. If these dates fall on a weekend or holiday, the due date is moved to the next business day. Timely submission of each payment portion is important in avoiding potential interest and penalties. Having your printable 2023 IRS Form 1040-ES organized can make a significant difference in keeping with these deadlines and ensuring that your quarterly tax obligations are met without unnecessary stress.